Profile: Canadian Cannabis Tourism Alliance

The Canadian Cannabis Tourism Alliance (CCTA) is at the forefront of establishing Canada as the world’s premier cannabis tourism destination. This dynamic organization comprises business owners, advocates, and cannabis professionals united by a common goal: to build a vibrant and sustainable cannabis tourism industry nationwide.

The CCTA is actively engaged in advocating for crucial policy changes, pushing for regulations that would enable everything from cannabis sales at public events to the establishment of consumption lounges. Their forward-thinking approach, evident in their 2024 plan to position Canada as the global cannabis tourism hub, highlights their commitment to shaping a responsible and thriving sector.

Beyond advocacy, the CCTA fosters industry growth through education, partnership development, and facilitating new business opportunities. They’ve already showcased their dedication with events like the “420 Cannabis Tourism ExtravaGanja” in Niagara Falls in April 2025, demonstrating their practical efforts to bring cannabis tourism experiences to life for consumers and professionals alike.

For more information including how to join, visit:

https://www.canadiancannabistourism.com/

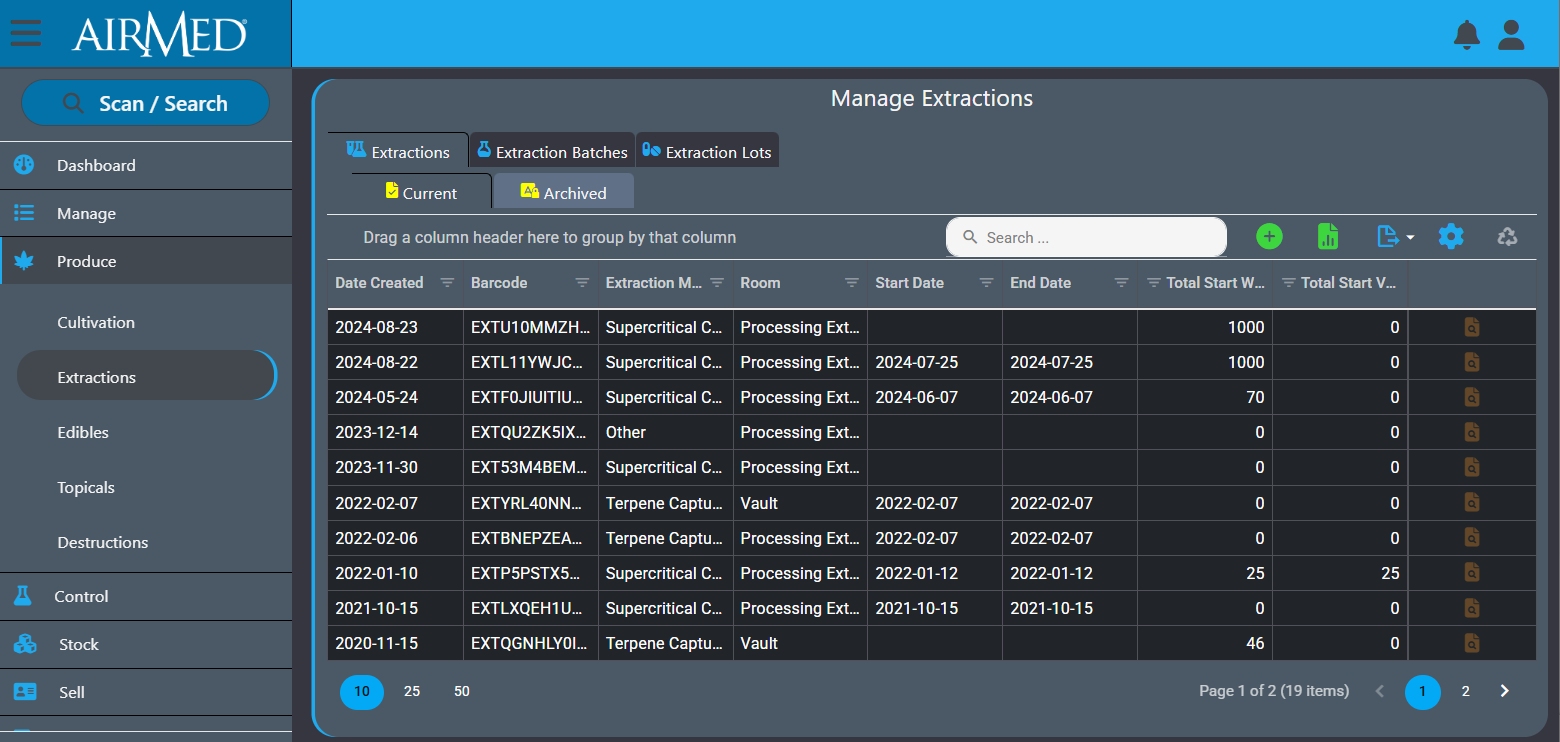

AirMed: Scalable Software for Your Cannabis Business

Last week we discussed building a scalable and sustainable business. Read the post here: Sustainably Scaling Your Cannabis Business.

Creating a cannabis business that is both scalable and sustainable is the best way to deal with an uncertain economy. One of the keys to scalability lies in having tools that can handle a varying volume of transactions, inventory, and data.

Our cannabis management software is designed with scalability in mind. Whether you’re a startup or a large enterprise, our platform grows with you.

Scaling up operations can mean more complex processes, such as adding new product lines, expanding to new locations, or hiring additional staff. AirMed lets you handle these complexities with ease. Features such as multi-location support, role-based access, and centralized reporting help you streamline processes and avoid bottlenecks.

AirMed manages every aspect of cultivation, processing, packaging, and distribution. We also offer quality management, workforce management, CRM and ERP-level functionality.

You can automate a series of tasks and assign them to different departments or users with activities cascading across the entire production cycle. Plan templates let you create formulas after completing the cultivation, drying and packaging of a successful batch. Our software automates inventory management and monitors stock levels in real-time to let you adjust to fluctuating demand.

With integrated tools for sales reporting, AirMed can provide data-driven insights to help you make smarter decisions. Whether it’s forecasting sales trends, identifying popular products, or tracking seasonal demand, data becomes even more valuable as the economy fluctuates.

Our system is module to let you add functionality if and when needed. We also offer flexible billing options, and we’re currently developing a lower-cost ‘lite’ version of AirMed to help micros. A limited feature set and simplified workflows will get your smaller operation up and running while ensuring that you meet compliance and stay within budget.

Investing in scalable software ensures that your business can handle changing demand, variable inventories, and flexible operations to set the stage for long-term success. With the right system in place, you can focus on your business, while knowing that your operations are efficient, compliant, and sustainable.

For more information visit our Software page or our Compliance page.

Sustainably Scaling Your Cannabis Business

As the cannabis industry fluctuates, businesses must be prepared to scale operations depending on demand. Building a scalable, but also sustainable, cannabis operation is about more than just sales or product. It’s about creating a foundation that allows your business to deal with varying volumes of transactions, inventory, and data without introducing inefficiencies or compliance risks. Your operations should be flexible enough to accommodate your current demands while being adaptable to whatever the future has in store.

Scaling Up

During upturns, your sales volume and inventory size will inevitably increase, so your operations must be able to handle that. Your production may become more complex as a result, and you may want to expand. Whether you’re adding new product lines, opening new facilities, or hiring additional staff, be conscious of overbuilding infrastructure in case of a downturn. If you do decide to invest, look for systems that will support long-term efficiency. And ensure that whatever you scale up can be scaled back if needed.

1. Increase operations incrementally or modularly. Add capacity in blocks based on actual demand, or partner with those who can provide what you lack to reduce up-front costs.

2. Maintain your cash flow and build reserves during growth phases to cushion slumps. Avoid overleveraging and watch your ‘burn rate.’ Scale in ways that don’t push your operating expenses to unsustainable levels.

3. Grow where you’re strongest. Deepen presence in high-margin, high-loyalty markets before chasing expansion. Defend your base by building brand equity and customer loyalty with retention strategies before aggressively acquiring new customers or markets.

4. Diversify selectively. If you want to diversify, offer a mix of premium and budget-friendly options to serve customers in both boom and bust conditions. If feasible, expand into sectors or geographies less exposed to fluctuations.

5. Invest in people, culture, and leadership. For long-term sustainability, hire selectively and cross-train to build a team that can wear multiple hats if needed. Encourage adaptability, learning, and resourcefulness. Create strong leaders, a key to weathering uncertainty.

Scaling Down

During a slow economy, the best way to deal with a situation that seems beyond your control is to ensure that you have control over everything you can.

1. Streamline operations and optimize cultivation to reduce waste and increase profits. For example, using data analysis on lighting, nutrients, and water usage can increase yield without compromising quality.

2. Prioritize high-margin products and markets. Evaluate strains, product formats (e.g., pre-rolls, vapes), and brands to determine which sell reliably and offer the healthiest margins. Increase or reduce efforts in specific markets depending on performance metrics.

3. Incentivize loyalty. Offer discounts, product education, or other incentives to existing clients and partners. Encourage pre-paid orders or early payment discounts to improve cash flow.

4. Communicate transparently. Be upfront with all stakeholders about the current conditions. Encourage ideas from frontline workers on efficiency and even company direction, and show investors you’re taking disciplined, strategic action.

5. Utilize scalable systems and tools. Your equipment, software and services should scale with your business needs. Discuss temporary options with your vendors such as reduction of services to control short-term costs while maintaining long-term relationships.

Conclusion

By staying agile and innovative, you can pivot quickly when needed. And by utilizing all available data, you can improve decision making throughout your operations. This will help you invest selectively in growth-enablers to give you the best return on investment (ROI) whatever the economy throws at you.

For more information visit our Software page or our Compliance page.

Profile: ABLE BC, the voice of BC’s cannabis stores

The Alliance of Beverage Licensees (ABLE BC) is the voice of British Columbia’s bars, pubs, and private liquor and cannabis stores.

A non-profit organization funded by membership dues, ABLE’s mission is to help British Columbia’s liquor and cannabis businesses succeed.

On behalf of the organization’s 1,000 members, ABLE BC works with all levels of government to create business-friendly policies and enhance private sector opportunities.

Headquartered in Vancouver, the association offers advocacy work, member benefits and discounts, and direct access to the latest industry information and policy expertise for cannabis retail members.

According to the organization’s website, ABLE BC “works hard every single day to advocate for your interests, protect your businesses, and help ensure the survival of the cannabis retail and private liquor industries.”

For more information and to sign up for ABLE BC’s free newsletter, visit:

https://ablebc.ca/

Streamlining Cannabis Inventory Management

Effective inventory management is crucial in the cannabis industry. With strict regulations governing everything from product tracking to distribution, any inefficiencies or inaccuracies can result in legal issues, loss of product, or lost revenue.

Cannabis businesses, whether cultivators, manufacturers, or retailers, are tasked with managing complex inventory systems that require real-time updates, accurate tracking, and compliance with provincial and federal laws. This is where cannabis management software can come into play.

Software that provides advanced inventory management functionality helps automate and streamline processes, while tracking every product, at every stage.

With features like barcode scanning and real-time inventory updates, cannabis businesses can gain a clear, up-to-date view of their inventory. This transparency helps to minimize human error and avoid overstocking or stockouts—both of which can have serious financial implications.

Inventory management can streamline processes like harvesting, trimming, packaging, and distribution, reducing resources. A good inventory management system can also detect shrinkage from spoilage, mislabelling or theft for better cost control and waste reduction.

Inventory data can be used to anticipate demand, plan crops, or shift production toward high-margin products. A producer can improve supply chain decisions and lead times for restocking. Meeting demands without delays and ensuring consistent availability across dispensaries or partners ultimately results in enhanced customer satisfaction.

While operational efficiency is the most obvious result of streamlining inventory management, by providing insights into trends and sales patterns, businesses can make data-driven decisions to optimize all processes and increase profits.

AirMed has been 100-percent Canadian owned and operated since it was created in 2014. Click the Request Demo button at the top of the page today to explore AirMed in a free walkthrough and learn what home-grown can do for you.

For more information about AirMed visit our Software page.

Health Canada Seeks Feedback on Natural Products with Cannabidiol by June 5

A consultation is under way by Health Canada called: Towards a pathway for health products containing cannabidiol. The goal of this public consultation is to consider permitting cannabidiol (CBD) as a medicinal ingredient in natural health products. This would require amendments to Schedule 2 of the NHPR and the PDL.

“If these amendments are made, Health Canada would have the ability to regulate NHPCCs under the NHPR [natural health products containing cannabidiol]. Provided that a product licence application for an NHPCC meets the licensing requirements in the regulations, such products could then receive a natural product number (NPN). This number indicates that Health Canada has reviewed and authorized a product.”

In the consultation document, Health Canada states, “There has been continued interest from stakeholders to include CBD in health products available without a prescription and consumers who want to access them. As a result, Health Canada committed to looking at a potential regulatory pathway for NHPCCs that may be accessed without a prescription.”

The consultation began in March and the deadline for submission of feedback is June 5, 2025.

For more information on this consultation including how to participate visit:

https://www.canada.ca/en/health-canada/programs/consultation-towards-pathway-products-containing-cannabidiol/natural-health-products.htmlFor an in-depth analysis of this consultation visit Stratcann:

https://stratcann.com/news/health-canada-seeks-more-feedback-on-cbd-as-a-natural-health-product-and-cbd-for-pets/

AirMed & Product Diversification

In a recent post, we discussed the benefits of product diversification for cannabis producers. Read the post here: https://airmedcloud.com/benefits-product-diversification/

If you have a diversified product range or are considering diversifying, know that AirMed is here for you. No other cannabis management system offers the breadth of functionality, ease of use, and comprehensive features to cover all classes of cannabis.

- Dried cannabis

- Fresh cannabis

- Cannabis plants

- Cannabis plant seeds

- Cannabis edibles

- Cannabis extracts

- Cannabis topicals

Some cannabis products, such as extracts, edibles and topicals, are categorized as special classes due to the unique public health and safety risks they present. As a result, these have specific requirements pertaining to their formulation, production and composition. AirMed offers features designed specifically for those cannabis classes. There are dedicated workflows for storing extractions after processing for further processing or for blending with other materials and more. Weights are tracked to five decimal places for precision and reporting.

Packaging features in AirMed include the ability to create discrete units such as edible gummies or gel caps, which can be recorded individually in groups or as bulk packages.

Our system offers GS1 barcoding and configuration for tracking product cases and master cases. And all labels are produced and created from within AirMed and can be customized to your needs.

With more stringent requirements for some cannabis classes comes a greater need for control and risk mitigation. Access to AirMed software functionality is controlled on a user-by-user basis. Workforce management in our software utilizes configurable departments and job roles to control which workflows workers are authorized to use. You determine who is given rights to these production areas based on the needs of assigned job roles.

We’ve also provided a range of quality management (QMS) features to support Good Production Practices (GPP) and a Preventive Control Program (PCP).

To maintain compliance with Health Canada and accurately complete the monthly CTLS report, licenses processes have specific data management requirements. We’ve already accommodated those needs with data automatically populated in the CTLS Worksheet Tool.

AirMed not only accommodates compliance reporting but business intelligence as well. Hundreds of pre-built reports are available for sales, clients, inventory, production and more.

And AirMed can manage multiple client facilities, and data can be partitioned to each respective facility.

AirMed has been 100 percent Canadian owned and operated since it was created in 2014. Click the Request Demo button at the top of the page today to explore AirMed in a free walkthrough and learn what home-grown can do for you.

For more information about AirMed visit our Software page.

The Benefits of Product Diversification

A Strategic Advantage for Producers

Cannabis producers are continually seeking ways to stay competitive and expand market share. One strategy for achieving these objectives is through diversification, which can include edibles, extracts, topicals, and even non-psychoactive CBD products. Diversification not only mitigates many of the risks associated with market volatility but also presents opportunities for innovation, efficiency and sustainability.

Risk Mitigation: The market for cannabis is subject to external pressures such as regulatory changes, shifts in consumer preferences, and economic fluctuations. By developing a range of products, manufacturers can buffer against these uncertainties. If one product line faces a downturn due to new regulations or market saturation, having a portfolio of alternative products can help maintain revenue streams.

Market Expansion: Diversification lets cannabis producers tap into different market segments to increase their chances of capturing market share in an expanding and competitive landscape. The cannabis market is no longer limited to flower smokers; consumers now seek items tailored to their preferences, such as edibles, tinctures, topicals, concentrates, and even beverages or health-focused CBD products. Each product range appeals to different demographics, from those who prefer discreet consumption methods to those interested in recreational or medicinal benefits. By offering a broad spectrum of products, producers can attract a wider consumer base, including those who might not typically engage with traditional cannabis products.

Innovation & Brand Loyalty: By innovating, producers can set trends rather than follow them, creating unique offerings that can become synonymous with their brand. This not only helps capture market attention but can also build strong brand loyalty. Consumers are more likely to remain loyal to a brand that consistently offers new, exciting, and effective products. Customers who have a good experience with a flower product may gain the confidence to explore edibles, tinctures, or wellness items from the same producer. Offering a wide variety of high-quality products enables cannabis producers to build stronger relationships with consumers. Moreover, diversifying helps a brand stand out from competitors, positioning it as a one-stop shop. Building an extended portfolio reinforces brand reputation and credibility in a market where consumer trust is essential.

Efficiency & Sustainability: Diversifying product lines can lead to better utilization of resources and contribute to environmental sustainability. Different products might use different parts of the operation, ensuring that waste is minimized, and all plant materials are used more efficiently. This can lead to economies of scale, potentially lowering the cost per unit and reducing the environmental footprint, which can appeal to environmentally conscious consumers.

Compliance with Evolving Regulations: The cannabis regulatory landscape is continuously changing, with regional laws specifying what types of products can be sold. By diversifying, producers are better positioned to adapt to regulatory changes. If one jurisdiction bans smoking, a producer with a line of edibles or topicals can still serve that market, maintaining presence and revenue.

Conclusion

Diversification offers a way to manage risk, expand market reach, foster innovation, optimize resources, comply with regulations, and contribute to sustainability. For cannabis producers looking to thrive, diversifying can be the answer. By expanding portfolios, producers can reach new customers, reduce financial risks, stay ahead of trends, and increase profitability. As the industry continues to mature, those who embrace product diversification will likely lead the market, setting standards and capturing the diverse needs of consumers worldwide.

AirMed has been 100 percent Canadian owned and operated since it was created in 2014. Click the Request Demo button at the top of the page today to explore AirMed in a free walkthrough and learn what home-grown can do for you.

Watch for an upcoming post on how AirMed handles a range of cannabis products and classes. In the meantime, visit our Software page.

Report: Cannabis Cultivation Market 2025

The Cannabis Cultivation market report covers market characteristics, size & growth, segmentation, regional & country breakdowns, competitive landscape, market shares, trends and strategies for this market.

This is one of a series of reports on the cannabis industry published by Research and Markets, an industry analysis firm headquartered in Dublin Ireland.

The analysts at Research and Markets predict the cannabis cultivation market will grow from $179.32 billion in 2024 to $208.64 billion in 2025 at a compound annual growth rate (CAGR) of 16.3%. “The growth in the historic period can be attributed to legalization trends, medical use acceptance, consumer awareness, investment inflow.”

The reports goes on to predict the cannabis cultivation market “will grow to $407.91 billion in 2029 at a compound annual growth rate (CAGR) of 18.2%. The growth in the forecast period can be attributed to research and development, sustainable practices, consumer education.”

Although the full 200-page report is expensive, the description and executive summary are free and provide excellent information on the marketplace including the following points.

- The adoption of cannabis for treating chronic diseases is anticipated to drive the growth of the cannabis cultivation market in the future.

- The increasing public acceptance and demand for cannabis are expected to boost the growth of the cannabis cultivation market going forward.

- Product innovations are a key trend gaining popularity in the cannabis cultivation market.

To read the description & executive summary of this report, visit:

https://www.researchandmarkets.com/reports/5766626/cannabis-cultivation-market-report

Study: Medical Cannabis in Older Patients

A study carried out by representatives of the University of Victoria and the commercial cannabis industry reports that “Approximately 90% of patients used medical cannabis to treat pain-related conditions such as chronic pain and arthritis. Almost all patients reported a preference for oral cannabis products (e.g., extracts, edibles) rather than inhalation products (e.g., flower, vapes), and most preferred oral formulations high in cannabidiol and low in tetrahydrocannabinol.”

This study aimed to assess the patterns of medical cannabis use in patients over 50 years of age and its effect on health outcomes such as pain, sleep, quality of life, and co-medication.

The Medical Cannabis in Older Patients Study (MCOPS) had treating physicians collecting detailed data on participant characteristics, medical cannabis and co-medication use, and associated impacts on pain, sleep, quality of life, as well as adverse events.

There were 299 participants with an average age of 66.7 years, 66.2% of which identified as female.

“Over the six-month study period, significant improvements were noted in pain, sleep, and quality of life measures, with 45% experiencing a clinically meaningful improvement in pain interference and in sleep quality scores. Additionally, nearly 50% of patients taking co-medications at baseline had reduced their use by the end of the study period, and quality of life improved significantly…”

The study was published by the Research Society on Marijuana and can be accessed here:

https://publications.sciences.ucf.edu/cannabis/index.php/Cannabis/article/view/239An article summarizing the results was published on Norml.org, an organization whose mission is to move public opinion sufficiently to legalize the responsible use of marijuana by adults, and to serve as an advocate for consumers to assure they have access to high quality marijuana that is safe, convenient and affordable.

https://norml.org/blog/2025/02/21/study-cannabis-use-in-older-patients-associated-with-improved-quality-of-life-lower-demand-for-prescription-drugs/

Report: Global Cannabis 2024-2028

The Global Cannabis Report: 5th Edition delivers a thorough analysis and insight into the world’s key cannabis markets, organised by region. This edition explores the global evolution of cannabis markets and examines possible future developments on the international stage. Additionally, it highlights the most notable and relevant trends in the industry, offering regional insights, market sizing data and analyses, and exclusive interviews with cannabis industry experts from around the world.

This report is produced by Prohibition Partners, which provides specialist information, data analytics and digital commerce solutions to the B2B cannabis industry.

For more information and to download the ‘Lite” version of the report for free, visit:

https://prohibitionpartners.com/reports/the-global-cannabis-report-5th-edition/

10 Ways to Increase Cannabis Profits in 2025

High taxes, market saturation, and increased competition are cutting into profit margins for cannabis producers in Canada. In some areas, oversupply has driven prices down, affecting profitability for both growers and retailers.

With so many challenges complicating efforts for legitimate businesses to thrive, what can cannabis producers do to increase profits? We’ve compiled 10 strategies to help you cultivate success in the upcoming new year.

1. Diversify Product Selection: Broadening your offerings to include edibles, topicals, oils, and tinctures can create a wider customer base.

2. Target Niche Markets: Focusing on specific demographics or consumer needs, such as organic or medical cannabis, can establish a unique selling proposition.

3. Expand Distribution Channels: Export markets can offer new channels for Canadian cannabis, but be aware that meeting compliance in other regions can be costly. There are, however, alternatives. Selling to GMP-compliant organizations is one. Another is boosting your reach in Canada by partnering with retailers or large distributors and by selling online through direct delivery programmes.

4. Educate Consumers: Providing educational materials about product benefits and applications can strengthen customer engagement and drive sales.

5. Enhance Quality Control: Establishing high-quality cultivation practices can lead to superior products allowing for premium pricing and inspiring customer loyalty.

6. Optimize Processes: Creating formulas for cultivation or manufacturing by developing repeatable plans, templates, and recipes can ensure success again and again and trim waste.

7. Operate Efficiently: Streamlining through automation, standard operating procedures and improved resource management can reduce costs and increase output.

8. Minimize Risks: Active prevention through workforce management, approval workflows, and incident tracking lowers expenditures resulting from errors and damages.

9. Systemize Compliance: Having a system in place to administer compliance and stay ahead of regulatory changes can protect profits.

10. Improve Decision Making: Utilizing business intelligence and data analytics to track operations and consumer trends can help you make better decisions toward future success.

By implementing these strategies, cannabis producers can position themselves for greater financial success in a competitive market.

For information on the many ways AirMed can help you improve profitability, click the Request Demo button at the top of the page and a team member will be in touch. In the meantime, visit our Software page.

Cannabis Industry Forecast for 2025

What’s in the cards for cannabis in 2025? We’ve rounded up some of the predictions.

A report from insurance brokerage Hub International states that “In a volatile marketplace, risk mitigation will separate success from failure.” The document contains results from HUB’s Executive Outlook Survey, which polled 900 C-Suite and VP-level executives on the issues facing them on profitability, employee vitality and organizational resilience. “Outlook 2025 Cannabis” discloses that 80% of Canadian cannabis companies identified rising costs as the biggest challenge to profitability, but only 65% feel prepared to address it. https://www.hubinternational.com/en-CA/insights/outlook/2025/cannabis/

BNN Bloomberg posted a video titled, “Challenges in Canada’s Cannabis Sector,” featuring an interview with Ben Kaplan, author of Catch A Fire: The Blaze and Bust of the Canadian Cannabis Industry. Kaplan, a Brooklyn-born and Toronto-based writer and editor and the founder of KIND Magazine distributed in Canada’s legal weed shops, claims the industry is currently “right-sizing”. https://www.bnnbloomberg.ca/video/shows/the-open/2024/12/24/challenges-in-canadas-cannabis-sector/

Ben Kaplan also penned an opinion piece for the Globe & Mail titled, “Forgotten in the cannabis crash is how the industry is a Canadian success story.” https://www.theglobeandmail.com/business/commentary/article-forgotten-in-the-cannabis-crash-is-how-the-industry-is-a-canadian/

Investing News Network published “Cannabis Market Forecast: Top Trends That Will Affect Cannabis in 2025.” While mostly focused on the U.S. market, the article mentions Canada. Overall, INN predicts that “2025 could be a year of transformation for the cannabis industry.” https://investingnews.com/cannabis-forecast/

For general and breaking news on the Canadian cannabis industry, visit one of the sites below.

Cannabis in Canada Review for 2024

There’s something about the end of one year and the beginning of another that makes people want to look back as they leap forward. End-of-year recaps are common in the news. But when we looked, we found many covering the U.S. cannabis industry and the process of decriminalization. But there were almost none about Canada. So we turned to ChatGPT, a type of artificial intelligence trained on large amounts of text data that uses an algorithm called a transformer to generate text. After scouring the Internet, ChatGPT came up with the following key developments for the Canadian cannabis industry in 2024.

Maturing Legal Market

The legal cannabis industry in Canada is entering its fifth year since the nationwide legalization in 2018. While the initial enthusiasm has settled, the market is now focusing on consolidation, innovation, and consumer education. Cannabis sales remain strong, but growth rates have slowed compared to the initial years. There is now a greater emphasis on quality and differentiation rather than simply expanding the market.

Industry Challenges

Despite initial optimism, the cannabis industry faces significant challenges:

- Profitability Issues: Many cannabis companies continue to struggle with profitability due to oversupply, high taxation, and competition from the illegal market. Prices have come down, but not always enough to outcompete illicit operators.

- Regulatory Hurdles: Companies are still navigating complex regulations, particularly around packaging, labeling, and marketing. The government has been slow to adjust some of these regulations to allow for more dynamic industry growth, such as expanding retail hours or reducing restrictive rules for cannabis advertising.

- High Taxes and Licensing Fees: The federal and provincial governments have kept taxes high on cannabis, which has affected margins for producers and retailers.

Expanding Product Offerings

In 2024, cannabis companies have expanded their product offerings, with a continued shift towards innovative products beyond dried flower, including:

- Edibles and Beverages: Cannabis-infused beverages and edibles have gained significant traction, providing a more discreet and enjoyable consumption method. These products are now a larger portion of the legal cannabis market.

- Vapes and Concentrates: Vaping continues to be popular among cannabis consumers, though it faces some regulatory scrutiny due to health concerns. Concentrates, like hash and distillates, are also on the rise.

- Medical Cannabis: Medical cannabis is still a crucial market, with more people accessing it for health-related reasons. New research and trials have also driven more interest in medical products, particularly those with a focus on CBD.

Consumer Trends

Consumer preferences have become more sophisticated. In 2024, Canadian cannabis consumers are looking for quality, consistency, and variety. This includes an increased demand for:

- Sustainable and Organic Products: Consumers are increasingly seeking environmentally friendly cannabis options, pushing producers to adopt sustainable farming practices.

- Microdosing: With more people seeking subtle, controlled experiences, microdosing has become a prominent trend, especially in edibles and tinctures.

- Brand Loyalty: As the market matures, consumer brand loyalty is becoming more pronounced, with established companies gaining recognition for their quality and reliability.

Legal Developments

The Canadian government continues to tweak the legal framework around cannabis in 2024. Several provinces are exploring the possibility of relaxing some restrictions:

- Expansion of Retail Stores: While Ontario leads in retail outlets, provinces like British Columbia and Alberta are increasing their number of licensed dispensaries, making cannabis more accessible to consumers.

- Home Cultivation Rules: Discussions around expanding personal cultivation rights are ongoing, with some provinces exploring allowing more plants to be grown for personal use, while others remain restrictive.

- International Market Opportunities: As Canada’s domestic market stabilizes, there’s growing attention on international markets for cannabis exports. Canadian companies are positioning themselves to benefit from the global cannabis boom, especially in Europe and emerging markets.

Social and Cultural Changes

Cannabis is now more ingrained in Canadian culture than ever. Public attitudes have become more accepting, especially regarding medical and wellness use. However, some societal issues remain:

- Concerns about Youth Access: Despite strict age restrictions, there are concerns about the accessibility of cannabis to minors, particularly through online sales or in neighborhoods with high retail density.

- Workplace Policies: As cannabis becomes more mainstream, workplaces are adapting to accommodate employees who consume cannabis. Employers are grappling with issues surrounding cannabis use, workplace safety, and testing.

The Black Market’s Continued Impact

The illicit cannabis market remains a significant challenge. Although legalization has greatly reduced illegal cannabis sales, the black market still exists, driven by lower prices, a wider selection of products, and a lack of trust in the legal system. Tackling the black market through regulation adjustments and lowering taxes is seen as a key area for future policy development.

Conclusion

Overall, the cannabis industry in Canada in 2024 is in a phase of refinement. While there are still challenges like profitability, regulatory barriers, and competition from the illicit market, the industry is maturing and diversifying its offerings. Consumer trends are shifting towards quality, sustainability, and innovation, while legal and regulatory adjustments are set to shape the market in the coming years. As Canada’s cannabis market continues to stabilize, the industry is positioning itself for long-term growth, both domestically and internationally.

Thanks ChatGPT! Content courtesy of https://chatgpt.com/.

If you are looking for media reviews of the cannabis industry that include some information on Canada, please click the links below:

https://www.reuters.com/legal/litigation/cannabis-2024-year-review-2024-11-13/

https://investingnews.com/daily/cannabis-investing/cannabis-market-update/

Report: Veterans and Cannabis Mental Health

The Mental Health Commission of Canada (MHCC) has published a report titled Closing Research Gaps on Cannabis and Mental Health – Veteran-Specific Findings.

Over the past five years, MHCC has led a research program to assess the impact of cannabis on the mental health of diverse populations. MHCC recent released the results of studies that explored the relationship between cannabis and mental health among Canadian veterans.

“According to these studies, Canadian Veterans are significantly impacted by a range of physical and mental health conditions, which medical cannabis is frequently used to manage.”

Key findings in this report include the following.

- Veterans use cannabis for many reasons and experience a range of benefits and harms.

- The relationship between cannabis use and trauma is unique and nuanced for veterans.

- Barriers to accessing medical cannabis persist after legalization.

- Stigma prevents many veterans from accessing formal health-care supports.

The Mental Health Commission of Canada is a national non-profit organization created by the Canadian government in 2007 in response to a senate committee tasked to study mental health, mental illness, and addiction.

To read the full report, visit:

https://mentalhealthcommission.ca/resource/cannabis-synthesis-report-veterans/

Report: Statista Cannabis Market Data & Analysis

The 2024 Cannabis Market Data & Analysis Report from Statista, a global data and business intelligence platform, provides an international oversight into the Cannabis market. This 72-page report offers insight into drivers, current market trends, key companies, consumer insights, and future developments in the market.

“New product innovation and a shift in attitude towards cannabis from consumers and governments have led to a growing Cannabis market. Overall, the Cannabis market realized a revenue of US$59.4 billion worldwide in 2023.”

The analysts at Statista predict that the cannabis market will grow at a CAGR of 3.01% between 2024 and 2029. “Particularly strong growth is expected in upper-middle-income countries, due to the growing trend of changes in cannabis legislation and the corresponding expansion of supporting infrastructure.”

Statista reports, “Together, the Recreational and Medical Cannabis segments account for 51% of the total global revenue, due to the major sales of cannabis for recreational and medical-use in Canada and the United States.”

Statista is a global data and business intelligence platform with an extensive collection of statistics, reports, and insights on over 80,000 topics from 22,500 sources in 170 industries. Established in Germany in 2007, Statista operates in 13 locations worldwide and employs around 1,100 professionals.

For more information about this report visit: https://www.statista.com/study/119812/cannabis-market-data-and-analysis/

Celebrating the 50th anniversary of the barcode

The barcode, originally based on Morse Code, was invented and patented in the USA by Norman Joseph Woodland and Bernard Silver in 1952. However, it was more than 20 years before the invention became commercially successful.

Various organizations and companies played a role in the use of the barcode during those 20 years, but the real success began with a meeting of industry leaders in New York city in March 1971. It took another three years before a barcode that could be both printed easily and scanned easily was finally developed. In April of 1973, an industry-wide agreement on that barcode became the basis for GS1.

GS1, which stands for Global Standards, is a not-for-profit international organization that develops and maintains standards for barcodes and packaging identification.

The first barcode was scanned in the USA on the 26th of June 1974. Canada was the second country to introduce the barcode when a grocery store in Dorval, Quebec scanned the very first Canadian barcode.

The barcode was designed to make it easier for products to be tracked, processed, and stored. Today, these barcodes play a critical part in supply chains across the globe.

Available from 116 GS1 offices around the world, GTIN or Global Trade Item Number provides unique codes for a company and its products that can identified using electronic scanners.

GTIN employs a multi-digit number that is primarily used within barcodes. In North American, the UPC (Universal Product Code) is an existing form of the GTIN. In Europe, EAN-13 is the standard.

Cheers to all who had a hand in creating this useful tool that revolutionized the retail industry 50 years ago today.

For more information on GS1 and GTIN, visit,

https://www.gs1.org/standards/barcodesFor a history of the barcode, visit:

https://en.wikipedia.org/wiki/Barcode

Indigenous History Month and Cannabis News

AirMed would like to acknowledge June as National Indigenous History Month in Canada by providing links to Indigenous news and resources related to our industry.

APTN News recently discussed the 2024 federal budget with its cannabis implications for Indigenous communities in a feature on its website. Read it here: https://www.aptnnews.ca/featured/budget-2024-ottawa-federal-government-ontario-money-first-nations-inuit-metis/

Stratcann, the Canadian cannabis news and events platform for industry professionals, published a feature entitled, “Indigenous History Month focus: Indigenous cannabis news.” The post was a review of StratCann news “spotlighting Indigenous voices in both the successes and disputes, which are being heard loudly and clearly. Regardless of the outcome, the recognition of Indigenous peoples in the Canadian cannabis industry is stronger than ever.” Read it here: https://stratcann.com/news/indigenous-history-month-focus-indigenous-cannabis-news/

The Canadian Bar Association of British Columbia published a post recently titled, “Respecting Indigenous Regulation of Cannabis.” With the subtitle, “Time to turn over a new leaf,” the article discusses jurisdictional issues related to cannabis in Canada. Read it here: https://www.cbabc.org/BarTalk/Articles/2024/April/Features/Respecting-Indigenous-Regulation-of-Cannabis

In related news, a Nova Scotia judge rejected constitutional arguments for Indigenous cannabis shops. CityNews in Halifax posted a story about it here: https://halifax.citynews.ca/2024/06/14/nova-scotia-judge-rejects-constitutional-arguments-for-indigenous-cannabis-shops/

CBC also discussed the issue here:

https://www.cbc.ca/news/canada/nova-scotia/cannabis-emerging-new-battleground-over-mikmaw-rights-1.7151120

Last year MJBiz Daily published “Canadian panel urges bigger role for First Nations in cannabis industry.” This article recapped a Canadian Senate committee’s recommendations for regulations related to cannabis for First Nations. Read it here: https://mjbizdaily.com/canadian-panel-urges-bigger-role-for-first-nations-in-cannabis-industry/

The First Nations Health Authority offers a variety of resources on its website designed to help Indigenous youth make informed choices by providing information on the health impacts of using cannabis. View the resources here: https://www.fnha.ca/what-we-do/mental-wellness-and-substance-use/non-medical-cannabis

Report: European Cannabis 2024

The 9th Edition of the longest-standing annual report dedicated to Europe’s evolving and dynamic legal cannabis market is now available.

The European Cannabis Report: 9th Edition offers the most up-to-date insights and analysis on the evolution of key cannabis markets across Europe, including: Germany, the UK, Switzerland, the Netherlands and the Czech Republic.

Published by Prohibition Partners, a free-to-download version of the report is available that excludes market sizing analysis. For market sizing data and analysis, please see the paid-for packages.

For more information, including how to download a free copy of the report, visit:

https://prohibitionpartners.com/reports/the-european-cannabis-report-9th-edition/

Cannabis Consumption in Canada

Stats Canada published an article on April 19, 2024 that discusses various aspects of cannabis in Canada including production, sales, consumption, crime and even wastewater. The article combines government statistics with information from Canadian consumers.

The government agency reported that more than one in three Canadians adults are using cannabis. “In 2023, more than one-third of adults aged 18 to 24 years (38.4%) and 25 to 44 years (34.5%) reported using cannabis in the previous 12 months, compared with 15.5% of adults aged 45 years and older. About 1 in 10 adults aged 18 to 24 years (8.7%) and 25 to 44 years (10.3%) reported using cannabis daily or almost daily in the previous 12 months, compared with 4.8% of adults aged 45 and older.”

In a surprising statistic, the article also reports that out of every five dollars spent on legal cannabis, two dollars went straight into government coffers.

“Federal and provincial governments received $1.9 billion from the control and sale of recreational cannabis in 2022/2023, up by almost one-quarter (+24.2%) from a year earlier.”

To read the full article, visit Statistics Canada:

https://www.statcan.gc.ca/o1/en/plus/6091-cannabis-consumption-canada